1099 G Form Gambling

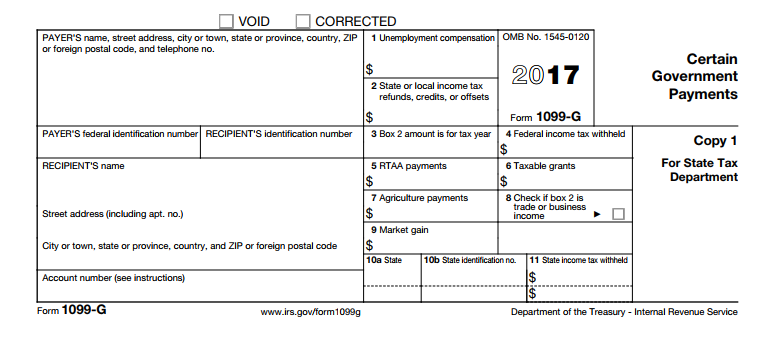

- 1099-G Form for State Tax Refunds, Credits or Offsets If the state issues you a refund, credit or offset of state or local income, that amount will be shown in Box 2 of your 1099-G form. The most common reason for receiving a refund is because of an overpayment of state taxes, as explained in the example below.

- Under the section titled Federal, State and Local Refunds subsection, enter the Income Tax refunds, credits or offsets from Box 2 of Form 1099-G.; In Refunds Attributable to post-20XX ES/extension payments (code 7), if applicable, enter the amount of prior year state and local income tax refund attributable to payments made after 12/31/20XX.

Form 1099-G Federal Form 1099-G, Certain Government Payments, is filed with the Internal Revenue Service (IRS) by New York State for each recipient of a New York State income tax refund of $10 or more.

Form W-2G is used to report gambling winnings. W-2G is different from Forms 1098 and 1099 in that the 1099 forms must be paper filed on red-ink forms while Copy A of Form W-2G can be printed on plain paper with black ink and mailed along with Form 1096 to the IRS.

If your gambling winnings are high enough, the payer must provide a IRS Form W-2G to you and to the IRS, reporting the amount of your gambling winnings.

The types of gambling fall under the following three headings:

- Horse Racing, Dog Racing, Jai Alai, and Other Wagering Transactions Not Discussed

- Sweepstakes, Wagering Pools, and Lotteries

- Bingo, Keno, and Slot Machines

Form W-2G is used to report income and withholding related to gambling. Generally, you will receive a Form W-2G if you receive:

- $600 or more in gambling winnings and the payout is at least 300 times the amount of the wager (except winnings from bingo, keno, and slot machines);

- $1,200 or more in gambling winnings from bingo or slot machines;

- $1,500 or more in proceeds (the amount of winnings less the amount of the wager) from keno; or

Any gambling winnings subject to federal income tax withholding.

Who must file Form W-2G

The payer, namely, the organization sponsoring the gaming event, must file Form W-2G when an individual wins a prize over a specific value amount. The form is used to report gambling winnings OR to report gambling winnings and any federal income tax withheld on the winnings.

Form W-2G due dates

Copy B and C is due to the winner by the end of January. Copy A is due to the IRS by the end of February. If you are filing electronically, you have until March 31 (an additional month) to file and you can seek also seek an extension of time to file.

How do I complete Form W-2G?

Check the “Corrected” box at the top of the W-2G form if applicable.

Enter the payer’s name, address, federal identification number and telephone number.

Enter the winner’s name and address.

Box 1. Enter the gross winnings.

Box 2. Enter the Federal income tax withheld. Federal income tax must be withheld at the rate of 25% on certain winnings less the wager.

Box 3. Select the type of wagers, which include: Horse track race, Dog track race, Jai-alai, State-conducted lottery, Keno, Bingo, Slot Machines and Other.

Box 4. Enter the date won!

Signature and Date. Sign and date Form W-2G if your are the only person entitled to the winnings.

Erich J. Ruth

Erich J. Ruth provides technical support for National Software which is the parent company for 1099FIRE. 1099FIRE develops and markets a comprehensive range of products that enables any size of business or institution to effectively manage and comply with year-end filing requirements. 1099FIRE is an employee-owned company located in Phoenix, Arizona.

+1099-DIV+(Dividends).jpg)

If you have any questions or comments about our software, feel free to contact us at any time.

The information in this article is up to date through tax year 2019 (taxes filed in 2020).

Every year, people flock to casinos in hopes of hitting it big. And since sports betting has been legalized, more people are engaging in gambling than before.

One thing to be aware of, though, is that certain winnings are taxable and are reported on IRS Form W-2 G. This document outlines your gambling winnings from a specific establishment. They should prepare the form to send to you and the IRS.

How do I get my Form W-2 G?

It’s the gambling establishment’s responsibility to fill out and submit Form W-2 G to the IRS. The copy that you receive is for you to report on your tax return. If you haven’t received your W-2 G or you lost it, contact the gambling institution to get it reissued, or contact the IRS directly since they will already have a copy.

Do I have to pay tax on my winnings?

Only winnings above a certain amount in certain games are reported on IRS form W-2 G. It is important to understand that “winnings” refer to the net amount. So, if you wager $1,000 and win $2,000, your winnings are $1,000.

1099 G Form Gambling Form

Only winnings above a certain amount from specific games will be reported on form W-2 G. Those include:

- Slot machine and bingo winnings of $1,000

- Keno winnings equal to or greater than $1,500.

- Pokertournament winnings exceeding $5,000

- Any lottery or sweepstakes winnings over $600

- Any other gambling activity in which you won 300 times the wager

Are winnings withheld for taxes?

This simple question, like most tax-related inquiries, has a complicated answer. Gambling establishments withhold 25% of winnings for individuals who have a Social Security number on file and 28% for all others. Since these winnings are included in taxable income, the individual’s tax bracket ultimately determines how much is withheld.

1099 G Form Gambling Winnings

Can I deduct gambling losses?

1099 G Form Gambling Certificate

Yes, losses can be deducted – although you won’t receive IRS form W-2 G outlining losses. Keep records of your wagers and losses. They will be reported on Form 1040, Schedule A as “Other Itemized Deductions.” Be aware, though, that the number of losses which are deductible cannot exceed the number of winnings reported on your tax return.